34+ Calculate monthly interest on loan

We will see the below result. For example purposes below is the amortization schedule showing the first five payments and last five payments of the balloon loan.

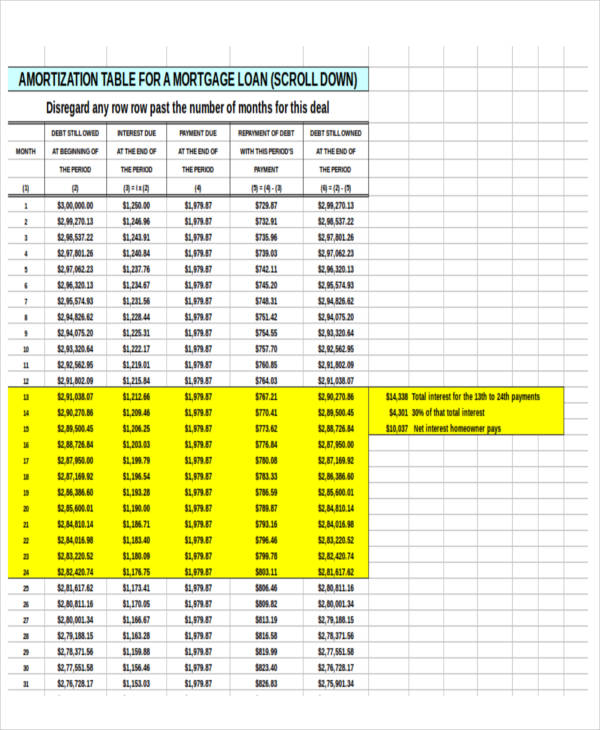

Tables To Calculate Loan Amortization Schedule Free Business Templates

To determine an interest rate for periodic payments divide the annual interest rate by the number of payments required within a year.

. Lets take a look at an example. Interest stays constant throughout loan tenure. That number is 500.

As another example a loan of 5000 was taken out at an interest rate of 5 per month to be repaid in one year. This amount is symbolized by the letter A in your formula. Heres how youd calculate the interest rate.

The table will also help you calculate the total interest cost. In general a good rate is one thats equal to or ideally less than the average. Formula used for calculation is - Interest Principal loan tenure interest rate per annum Total number.

Home buyers who have a strong down payment are typically offered lower interest rates. For the loan amounting to 200000 at a 6 interest rate for 10 years the monthly payment will be. Educational and Non-Profit Institutions Documents.

Overall EMI amount tends to be marginally higher. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. There are also ongoing costs with a mortgage.

Maximum of 300000 Undergraduate degree 500000 Graduate degree and 750000 Professional degree. Calculate the maximum loan you can get based on how much you want to pay on your auto loan each month. The right car loan needs to have an affordable monthly payment for your financial situation while providing plenty of room for your other monthly and unexpected expenses.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. If we want to know the amount of principal and the amount. Car Loan - With interest rates as low as 700 pa.

Calculate the total amount accumulated using the compound interest formula. Calculate the total cost of interest. This monthly payment includes a part of the principal amount and interest as well.

Use the formula A P 1 rn nt. If the rent is 2000 per month expect to pay 1000 in. Estimate your monthly loan repayments on a 300000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years.

The monthly payment could be figured out month by month. For starters define the input cells where you will enter the known components of a loan. Since your December 1 amortized payment is 59955 to figure the principal portion of that payment you would subtract the monthly interest number 500 from the principal and interest payment 59955.

10000 x 30 3000. Calculated on a monthly basis. Loan amount Monthly payment Total interest paid.

You cant deduct home equity loan interest if you use the money for other purposes. C3 - loan term in years. Many investors use the 50 rule.

Remember that Credit Unions usually offer lower interest rates than banks. Calculate your monthly payment here. Interest calculation depends on outstanding loan amount.

This amount decreases with each payment. C2 - annual interest rate. Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan.

Heres the standard formula to calculate your monthly car loan interest by hand. Heres how you would calculate loan interest payments. Once you have numbers for all the values you can determine the total amount of money that will be accumulated over the life of the loan or investment including interest.

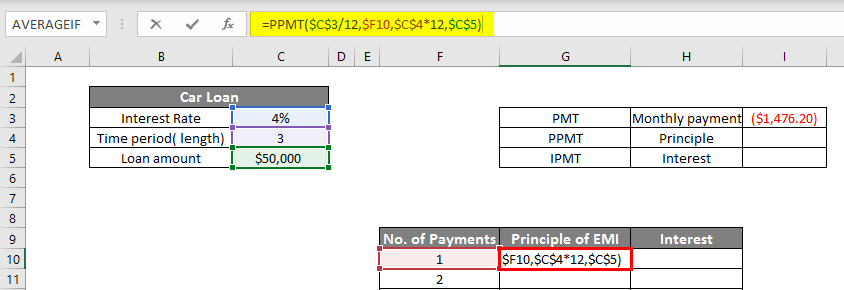

IPMT function - finds the interest part of each payment that goes toward interest. Compare Best Car Loan Interest Rates in. Monthly Payment Formula.

Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. For example a 9 annual interest rate is equivalent to a 0075 or 75 monthly interest rate 0912. This is the formula lenders use to calculate the total interest charge on the loan.

Lets assume you took out a 30-year loan with a fixed 4 interest rate. For example lets suppose you purchase a 350000 home and put down 50000 in cash. The principal is the original loan amount not including any interest.

Now lets go through the process step-by-step. May be requested after 36 consecutive on-time principal payments on principal and interest Loan amount Minimum of 10000. With each subsequent payment you pay more toward your balance.

You can take the loan for 90 to 100 of the on-road price of the car. If the monthly rent charged is 1500 expenses are 600 per month thats 40 for operating expenses. Fixed interest rate Starting at 234.

The SoFi 025 AutoPay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan. Divide the annual interest figure by 12 months to arrive at the monthly interest due.

Simply enter your desired monthly payment trade-in equity interest rate and term of loan in months. Overall EMI amount tends to be marginally lower. Starting from 534.

Principal balance x Annual interest rate x Loan term in years Total interest cost. The total interest cost is. A mortgage calculator uses your principal loan amount your monthly interest rate.

And a repayment tenure of up to 8 years you can find the most suitable car loan for your needs at BankBazaar. OMB Circular A-21 Cost Principles for Educational Institutions 05102004 109 pages 263 kb Relocated to 2 CFR Part 220 30. The calculator will let you know the maximum loan amount you can finance.

The Auto Loan Calculator is a quick and easy way to estimate a monthly payment while shopping for your new car. Second the annual interest rate would need to change to reflect the fact there are more payments. Monthly interest.

Well add the same 200 per month to cover water taxes and insurance. This is how we calculate monthly payments using the PMT function in Excel. Set up the amortization table.

Home buyers who have a strong down payment are typically offered lower interest rates. To generate a full amortization schedule use our calculator above.

Pin On Great Books For Kids

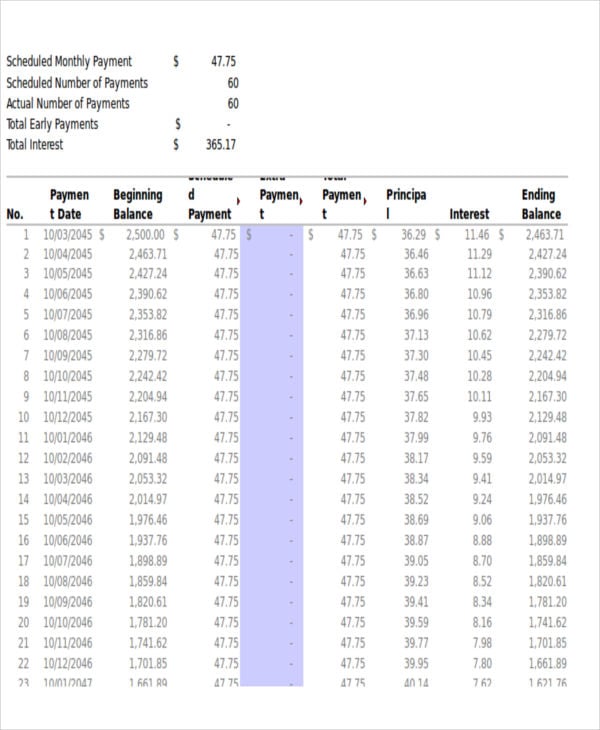

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

How To Do Number Sense Mental Math Wikihow Vychisleniya Matematika Umnozhenie

Tables To Calculate Loan Amortization Schedule Free Business Templates

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates

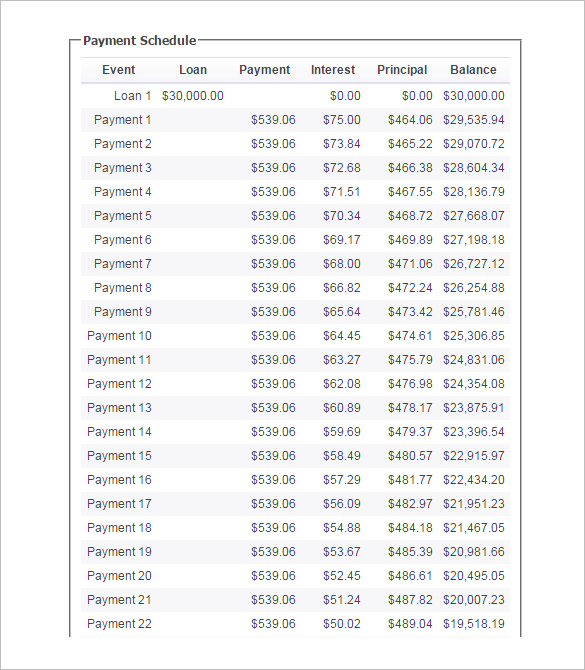

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

34 Payment Schedule Templates Word Excel Pdf Free Premium Templates

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

34 Payment Schedule Templates Word Excel Pdf Free Premium Templates

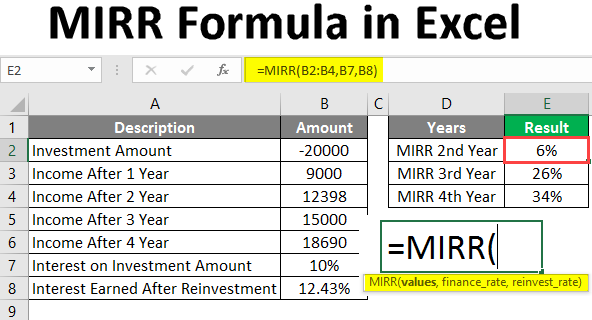

Mirr Formula In Excel How To Use Mirr Function With Examples

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Rent Roll Template 7 Writing A Cover Letter Cover Letter For Resume Statement Template